Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Job openings show signs of a slowdown

Job openings declined for the second straight month in May as the Federal Reserve's rate hikes slowed down overall demand.

Chart of the day: Service sector grows at slowest pace in two years

The ISM service index inched down to 55.3 in June, the slowest level of growth in more than two years since May 2020, when it was at 45.2.

U.S. June jobs preview: Slower hiring in rate-sensitive industries

We expect the June U.S. employment report to show a total gain of 225,000 jobs, with risk of a stronger pace of hiring and an increase in the unemployment rate to 3.7%.

RSM US Manufacturing Outlook Index shows a slowing industrial sector

Three of the Federal Reserve’s regional manufacturing surveys are now reporting outright contractions and the other two are falling quickly toward contraction.

Preparing for a tsunami of imported goods

The recent reopening of China’s factory floors and the easing of its supply chain bottlenecks have prompted discussion about the ability of the U.S.

New home sales rise unexpectedly despite higher mortgage rates

The increase was driven by more supply coming online, pushing prices down for the first time since February.

Five considerations for changing auditors

As your business grows, it's imperative to have an audit firm whose capabilities grow with you. Assess if it's time for a change.

IRS 90-day pre-examination compliance pilot for retirement plans

The IRS is piloting a pre-examination compliance program for retirement plans, which provides plan sponsors with 90-day window to review plan operations and make corrections prior to examination.

IRS to process all Forms 1040 originally filed in 2021 by end of week

Despite persistent challenges facing the IRS, the agency is on track to process all Forms 1040 originally filed in 2021 this week, with remaining inventory processed soon after.

Superfund excise tax FAQs and tax rates released by the IRS

The IRS issued FAQs regarding the Superfund chemical excise tax and tax rates today to help those taxpayers who may be impacted.

Preparing Your Business for a Recession

A recession can be challenging for any business. However, business owners can take steps to prepare for a recession and position their companies for growth as the economy recovers. In this video, we'll provide six tips to help you and your business prepare for a recession.

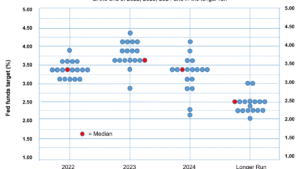

Fed announces largest rate hike in nearly three decades as it seeks to restore price stability

The Federal Reserve lifted its federal funds policy rate to a range between 1.5% and 1.75% on Wednesday as it moves to restore price stability over the medium term.

How lumber tells the story of home building during the pandemic

Large home builders operate with scale advantages, which have allowed them to endure wild swings in costs of inputs like lumber. It's a different story for…

IRS increases mileage rates for the remainder of 2022

The IRS provides some relief amid rising gas prices with an optional increase to the standard mileage rate for business travel.

Are inventory levels too high?

Consumer goods companies are beginning to rethink current inventory positions as they plan for back-to-school and winter holiday seasons.