Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

IRS announces details for ERC Voluntary Disclosure program

IRS provides VD Program for employers to return ERC refunds and avoid penalties and interest. Employers must apply by March 22, 2024.

Navigating the unexpected bid: a strategic guide to assessing an offer for your business

Are you equipped to assess an unexpected bid for your business? Learn how to strategically assess such bids with our latest article. Equip yourself with the knowledge to make the best decision for your business's future.

Year-end giving strategies for 2023

Make your year-end giving count! Discover the best strategies for 2023 to maximize your charitable contributions and tax savings in our latest article. Dive into the specifics of smart donating to ensure you're making the most of your generosity.

Accounting for income taxes: Book vs. tax basis differences

This whitepaper addresses how to identify temporary and permanent differences and net operating loss and tax credit carryforwards, which together are one of the many aspects of accounting for income taxes.

U.S. November Consumer Price Index: Inflation continues to abate

Inflation continued to abate in November as energy prices declined by 2.3% and gasoline prices dropped by 6%, resulting in a 0.1% monthly advance in the CPI.

FOMC preview and the logic of Fed rate cuts in 2024

After nearly two years of raising the federal funds policy rate to restore price stability, the Federal Reserve is poised to all but declare that campaign to be over at its meeting next week.

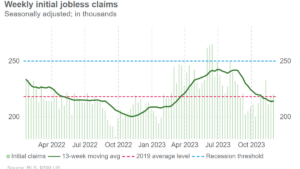

Initial jobless claims remain resilient

Initial jobless claims inched up slightly to 220,000 last week, remaining within the pre-pandemic level, the Labor Department reported on Thursday.

Early retirement withdrawals: avoiding the 10% penalty

Uncover potential circumstances under which you can tap into your retirement savings early without facing hefty penalties. From qualifying plan specifics to the latest updates in IRA rules, this article is your go-to resource for penalty-free withdrawal strategies.

What To Do With Old Retirement Accounts

You likely have at least one old retirement account if you've ever changed employers. These accounts stay exactly as you left them unless you take action. In this video, we'll provide options for what to do with those old accounts.

The 1031 Exchange Explained

In the world of real estate, the Section 1031 exchange has been a significant tool for investors who want to grow their real estate portfolio and wealth. In this video, we'll explain how a 1031 exchange works and important considerations when using one.

IRS delays implementation of lowered form 1099-K reporting threshold

The IRS has postponed the implementation of the new lowered reporting threshold for Form 1099-K. Learn more about this tax form and the impact of this delay on your financial planning.

Tax, Retirement, and Social Security changes for 2024

Are you prepared for the tax, retirement, and Social Security changes coming in 2024? Stay ahead with our expert insights and start planning your financial strategies today.

The DOL’s latest overtime proposal could impact your payroll

The DOL has a new overtime proposal on the table, and it could have major implications for your payroll. Learn about the potential changes and how they could impact your business operations.

Delaying retirement: a strategic move for financial security

Considering delaying retirement for better financial stability? This article explores the strategic advantages of working a few more years before you finally call it quits. Discover how this decision can significantly impact your financial security.

Maximizing your property’s potential: the Augusta Rule explained

Discover the tax benefits of the lesser-known Augusta Rule, where homeowners can enjoy tax-free income by renting out their properties for up to 14 days per year. Uncover how this can also serve as a unique tax strategy for business owners to claim deductions. Learn the eligibility criteria, potential pitfalls, and best practices to harness this opportunity.

No results found.