Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Inflation and gross margins—who is winning? Part 1: The transportation sector

RSM took a detailed look at gross margins across different peer groups in the industrials sector to see how each has fared during this time of high inflation.

Get ready for another round of supply chain bottlenecks

Just when middle market businesses where hoping for relief from supply chain disruptions, China's renewed economic shutdowns laying the groundwork from another round.

5 ways nonprofits can stay agile

To stay nimble, nonprofit organizations should examine these five areas to enhance their ability to adapt to change.

Financial institutions industry outlook

In our summer 2022 financial institutions industry outlook, we explore what's ahead for middle market business leaders.

OMB issues 2022 Compliance Supplement

The OMB has released the 2022 Compliance Supplement, which is effective for audits of fiscal years beginning after June 30, 2021.

IRS Announces Increases for HSAs and HDHPs in 2023

The IRS recently released new contribution limits for 2023 health savings accounts and excepted benefit health reimbursement arrangements and new requirements for qualifying high deductible health plans to reflect cost of living adjustments. Learn about the new limits and requirements in this article.

Ransomware-as-a-service: A new business model for cybercriminals

Ransomware-as-a-Service (RaaS) is a new business model for cybercriminals, making cyberattacks easier than ever.

Ransomware: Protecting your business against evolving risks

Ransomware attacks are increasing and threatening organizations of all sizes. The RSM cybersecurity report reveals new ransomware data.

Manufacturing sector grew steadily in May

The manufacturing sector expanded at the slightly faster rate in May as demand remained strong.

Income tax, charity and estate planning strategies for digital assets

Considering the income tax, charity and estate planning implications of digital assets, such as crypto, can minimize tax burden, comply with evolving regulations and pursue personal wealth goals.

Top 5 fintech trends to watch?—now, and in the future

The fintech movement is driving a rapid evolution within financial services, resulting in a new infrastructure and platform for the industry's next generation.

An update on the tax policy landscape against inflation backdrop

The tax policy landscape in Washington remains unsettled as we approach the summer months, while inflation remains the dominant economic issue. Within the context, we look at what's currently on the legislative agenda for Congress.

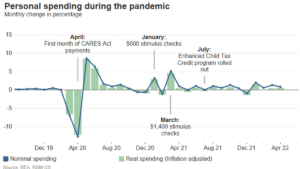

Personal spending and trade improved in April as inflation eased

American consumers continued to spend more in April as inflation showed signs of relief. The combination of higher incomes, excess savings and lower energy prices helped to alleviate some of the recent recession concerns.

Consider revisiting the Texas franchise tax during inflation

With the highest inflation rate in decades, and without a foreseeable end, businesses should re-examine the franchise tax calculation.

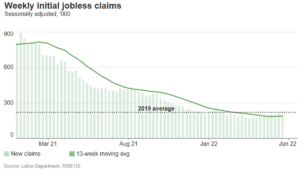

Initial jobless claims show signs of bottoming out

New filings for jobless benefits last week inched down to 210,000 as a tight labor market kept layoffs below pre-pandemic levels.

No results found.