Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Troubled Waters in the Commercial Real Estate Market?

Are we headed for a commercial real estate crisis? This article delves into the factors impacting the market and offers insights on how to navigate the uncertainty.

From Surviving to Thriving: The Benefits of Digital Transformation

Discover the benefits of digital transformation for businesses, including enhanced operational efficiency, real-time insights, and a competitive advantage in today's evolving market.

Mistakes To Avoid When Setting Growth Goals

Discover the common mistakes made when setting growth goals and how to avoid them. Learn how to create a clear and achievable plan to take your business to the next level.

Strong economic data signals another rate hike in July

A series of economic reports released on Thursday showed a much more resilient economy than expected heading into a crucial period when the Federal Reserve is on the verge of hiking interest rates again.

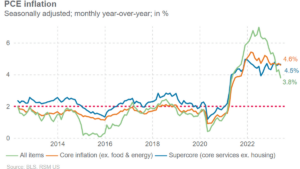

Spending and inflation cool in May

Inflation continued to decelerate in May as the Federal Reserve's key pricing metric—the personal consumption expenditures index—grew by only 3.8%

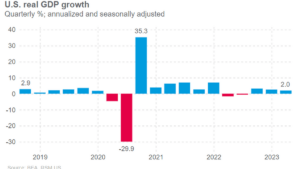

U.S. economy was a lot stronger in first quarter, final GDP estimate shows

The third and final estimate of gross domestic product showed a drastic upward revision to a 2.0% gain from 1.3% on a quarterly and annualized basis.

Business equipment spending rises for the second straight month

Despite May's top-line upside surprises in the durable goods report, our forecast for GDP growth in the second quarter stays at 1.8%.

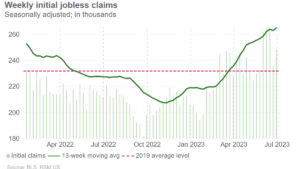

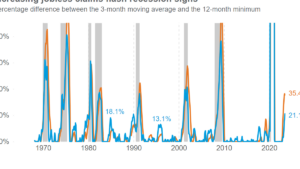

Is the economy headed for a recession? Jobless claims are saying yes.

Despite the labor market's resilience and persistently low claims compared to historical norms, the steady increases in claims since late last year are ringing alarm bells.

Common risks and opportunities audit committees should consider

These key risks and opportunities can help your audit committee see the power and potential of internal audit.

Fed pauses rate hikes while signaling a tightening bias

The Federal Open Market Committee on Wednesday kept its policy rate in a range between 5% and 5.25% while signaling that it will most likely hike the federal funds rate by 25 basis points at least twice before the end of the year.

Inflation relief in the pipeline as food, gas and service prices ease

Top-line U.S. inflation is moving back toward levels where it is appropriate for the Federal Reserve to pause in its efforts to restore price stability.

New guidance from IRS on correction of errors in qualified retirement plans

The IRS released Notice 2023-43 to provide interim guidance on plan correction changes under SECURE 2.0 until Rev. Proc. 2021-30 (EPCRS) is updated.

6 questions you need to ask about internal audit outsourcing

Faced with labor shortages and an unsteady economy, more organizations that used to perform internal audit functions in-house are turning to outsourcing.

The growing trend of pay transparency laws and their impact on employers

Are you up-to-date on the latest laws around pay transparency? This article highlights the key requirements and how to avoid common pitfalls. Gain insights into how pay transparency can benefit your business and attract top talent.

Financial red flags: a guide for nonprofit board members and directors

Protect your nonprofit organization from financial crises with these expert tips for board members and directors. Discover the warning signs of financial mismanagement and how to prevent them.

No results found.