Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Securing brand loyalty in a hyper-choice era

In an era of abundant choices, brand loyalty is a battleground. Learn about the importance and benefits of loyalty programs, the different types available, the use of technology to implement and manage them, and best practices for optimizing their performance. Discover how loyalty programs can help businesses attract and retain customers in a competitive landscape.

LLC liability: situations that could compromise your personal assets

Is your LLC really protecting your personal assets? Learn about the situations where an LLC may not fully safeguard your assets and discover practical measures to avoid them.

U.S. charitable donations fell last year

Donations to charity fell to $499 billion last year, a 3.4% decrease from 2021.

Back-to-school outlook: Consumers will seek value

The back-to-school season is influenced by shifting consumer behavior as families prioritize value-oriented choices.

Business orders for equipment rise despite higher borrowing costs

New orders for core capital goods, a proxy for business investment, came in higher than forecast in June, rising by 0.2%, the Commerce Department reported on Thursday.

Banking regulators give update on liquidity risk management

In a recent webcast update, the Federal Reserve Board of Governors, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. focused on the importance of liquidity risk management for banks.

HSA Limits for 2024: A Guide to Maximize Your Healthcare Savings

Discover the benefits of Health Savings Accounts (HSAs) and how they can help you save on taxes while covering your medical expenses. Learn about the increased contribution limits for 2024 and maximize the potential rewards of this often-underutilized healthcare savings tool.

ARMs in Focus: Rising Interest Rates and the Surge of Adjustable-Rate Mortgages

As interest rates rise, the popularity of adjustable-rate mortgages (ARMs) is also rising. Learn how ARMs work, their risks, and why you might choose an ARM over a fixed-rate mortgage.

Eight Essential Money Tips for New Grads

Graduation is exciting, but it also means taking control of your finances. Learn how to manage your money like a pro with these eight tips for new grads.

Troubled Waters in the Commercial Real Estate Market?

Are we headed for a commercial real estate crisis? This article delves into the factors impacting the market and offers insights on how to navigate the uncertainty.

From Surviving to Thriving: The Benefits of Digital Transformation

Discover the benefits of digital transformation for businesses, including enhanced operational efficiency, real-time insights, and a competitive advantage in today's evolving market.

Mistakes To Avoid When Setting Growth Goals

Discover the common mistakes made when setting growth goals and how to avoid them. Learn how to create a clear and achievable plan to take your business to the next level.

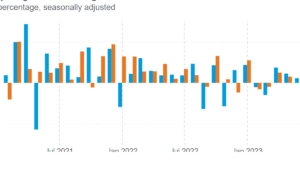

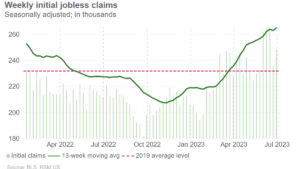

Strong economic data signals another rate hike in July

A series of economic reports released on Thursday showed a much more resilient economy than expected heading into a crucial period when the Federal Reserve is on the verge of hiking interest rates again.

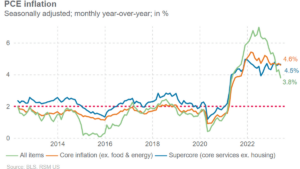

Spending and inflation cool in May

Inflation continued to decelerate in May as the Federal Reserve's key pricing metric—the personal consumption expenditures index—grew by only 3.8%

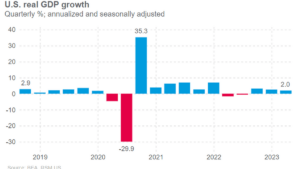

U.S. economy was a lot stronger in first quarter, final GDP estimate shows

The third and final estimate of gross domestic product showed a drastic upward revision to a 2.0% gain from 1.3% on a quarterly and annualized basis.