Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Bad debt tax deduction method proposed for financial institutions

Banks and insurance companies would see a simplification of their tax reporting of credit losses under proposed regulations.

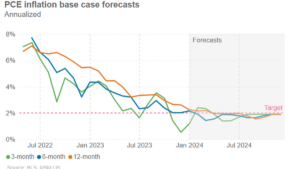

Revising our 2024 inflation outlook: Moving back to a 2% target

We expect the Fed to begin cutting rates in June, and that the central bank will reduce its policy rate four times this year, by 25 basis points each.

What are the benefits of managed payroll?

Managed payroll, also known as payroll outsourcing, can decrease risk, increase accuracy, protect sensitive data and better support your business.

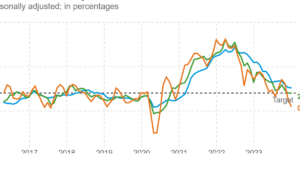

The Fed”s key wage gauge slows to lowest level since 2021

The overall index eased to 0.9% in the fourth quarter on a seasonally adjusted basis, down from 1.1% in the previous quarter.

FOMC policy decision: Setting the predicate for rate cuts

The Federal Reserve shifted its bias on monetary policy away from tightening to a balance of risks that favors neither rate hikes nor cuts.

Practical strategies for managing a sudden financial gain

Are you equipped to handle a sudden financial gain? Learn four steps you can take to navigate tax planning and potential tax burdens associated with a financial windfall.

Financial analysis of leasing vs. purchasing a vehicle

Understanding the financial differences between leasing and purchasing a vehicle can save you a significant amount of money. This article provides a detailed breakdown to help you make an informed decision.

Spending remains strong as a key inflation gauge declines toward Fed’s target

Inflation dynamics to close out last year strongly point to a near-term return to the Federal Reserve's 2% inflation target amid a solid labor market, strong spending and real income gains.

FOMC preview: Modest adjustments will lead to pivot by midyear

The FOMC next week will almost certainly leave its policy rate unchanged between 5.25% and 5.5% and maintain the pace of quantitative tightening.

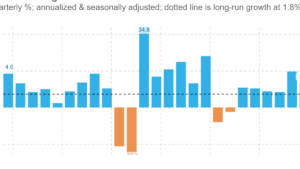

U.S. economy booms at a 3.3% pace in the fourth quarter

The U.S. economy last year expanded by a robust, above-trend pace of 3.1% and a fourth quarter pace on a seasonally adjusted rate of 3.3%.

Remote workforces are complicating state tax nexus and withholding

As businesses increase the use of remote workforces, nexus and withholding determinations can greatly complicate state tax compliance.

Compensation and benefits planning can help you navigate an aging workforce

Considerations for structuring compensation and benefit plans that help companies minimize the costs and risks of retiring workers.

The workers and workplaces of the future

How companies are adapting hiring practices and workforce strategies, given the shrinking U.S. labor force, according to the U.S. Chamber of Commerce.

From partnerships to side gigs, who really owes self-employment taxes?

Explore the impact of a recent legal shift that broadens the scope of self-employment taxes, including limited partners and gig workers. Learn how everyday activities could land you in the self-employment tax bracket and how to avoid potential penalties.

Self-employed? Here’s how to pick between a SEP IRA and Solo 401(k) for your retirement

Explore two popular retirement plans, SEP IRA and Solo 401(k), for the self-employed in this overview, focusing on their benefits, drawbacks, and the strategic considerations for choosing between them. Learn about higher contribution limits, flexibility, and tax advantages these plans offer. Get insight into which plan best fits your retirement goals and business structure.

No results found.