Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

FOMC policy decision: Fed hikes policy rate by 75 basis points

At this critical juncture, with the policy rate residing in neutral terrain, it is natural for the Fed to adjust its rhetoric as it considers next steps.

Wholesale gas futures point to drop below $4 a gallon

Wholesale gasoline futures imply that the average price per gallon of gas, which stands at $4.44, will most likely fall below $4 per gallon by the end of the summer.

FOMC policy decision preview: Fed to hike lending rate .75% next week

A 100-basis-point increase in the federal funds rate will be on the table during the Federal Open Market Committee meeting next week, but we expect the central bank will hike the policy rate by 75 basis points.

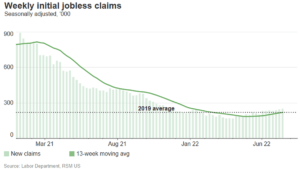

Initial jobless claims rise to eight-month high

New filings for jobless benefits rose more than expected last week to an eight-month high of 251,000, continuing to show signs of increases in layoffs amid an economic slowdown.

Overview and Benefits of a Stock Option Plan

A stock option plan can be used to align the interests of employees and shareholders, and attract and retain talented workers. This video will cover the basics of a stock option plan and how your company may benefit from having one.

Essential estate planning documents

Estate planning is an essential part of financial planning for all individuals, regardless of age or asset level. Learn which documents are essential for any estate plan and about other estate planning tools that may benefit you depending on your circumstances.

Summer jobs: tax considerations for parents and their children

For many teenagers, summer often means a time for family barbecues, swimming in the pool, and working a summer job. For many parents, this means dealing with the tax implications of their child’s income. In this article, we'll provide an overview of what tax filings may be required for your working teenager.

Tax issues that arise when a shareholder or partner dies

This article examines the various federal income tax issues, both from the individual and entity level, to be mindful when an owner of a passthrough entity dies.

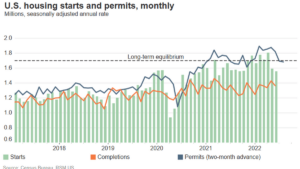

U.S. housing supply continues to fall amid rising mortgage rates

There were 1.56 million new housing starts in June on an annualized basis, a 2.0% decline from May and the lowest level since last September.

U.S. June CPI: Persistent top-line inflation hits 9.1%

The top-line consumer price index hit 9.1% in June on the back of a 11.2% increase in gasoline prices and a 7.5% jump in overall energy prices.

FASB clarifies fair value measurement guidance for equity securities

The FASB has clarified the measurement of the fair value of equity securities subject to contractual restrictions that prohibit the sale of the equity security.

In the consumer goods supply chain, the importance of consumer data

Supply chain disruptions and consumer products companies

Manufacturing: The ‘ground zero’ for U.S. supply chain disruptions

How manufacturing companies are navigating supply chain disruptions

IRS issues stern warning that abusive microcaptive insurance schemes will be aggressively targeted

The IRS has recently announced that it will aggressively review microcaptive insurance arrangements.

Cybersecurity report reinforces urgency for family office protection

For family offices, RSM’s cybersecurity special report highlights insights, data privacy trends, and tactics organizations can use to strengthen security and privacy programs.