Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

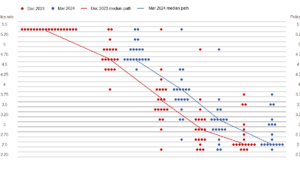

Fed holds rates steady as it implies three rate cuts in 2024

The primary takeaway from the Federal Open Market Committee's policy statement and forecast is that the Fed, along with other major central banks.

NetSuite tips and tricks: Account reconciliation

NetSuite's account reconciliation software helps automate reconciliation compliance and transaction matching processes.

Service sector continues to grow in February

The service sector continued to grow in February for the 14th straight month, according to the Institute for Supply Management on Tuesday.

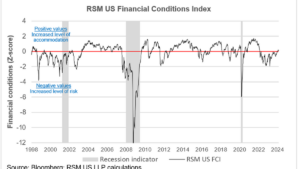

Geopolitical tensions and risks to the inflation outlook

Just as inflation appeared to be getting under control in recent months, rising tensions in the Middle East have shaken this view and now represent the major risk to our economic and inflation outlooks.

The price of eggs and the effect on public sentiment

With the economy growing at a healthy rate over the past year, one would think that Americans would be celebrating a boom.

Inflation expectations remain remarkably well anchored

The inflation shock of the past three years is abating. One reason is that expectations of future inflation continue to remain remarkably well anchored.

Smart finance for startups: 6 mistakes you can’t afford to make

Launching a startup is an exciting venture, but it's easy to overlook some crucial financial aspects. This article highlights six financial mistakes that can make or break your startup's success. Learn how to avoid these common pitfalls and build a thriving business.

Recent changes: retirement plan eligibility for long-term part-time employees

As of 2024, certain long-term part-time employees are eligible to participate in 401(k) plans. This article provides a detailed understanding of the changes to retirement plan rules brought about by the SECURE Acts.

Rollout of the IRS’s $1 billion penalty relief program

The IRS is offering a penalty relief program to taxpayers affected by its operational difficulties during the pandemic. Find out if you qualify for this program that is expected to impact around 5 million tax returns.

Building sustainable wealth: 5 key considerations for emerging high earners

Get valuable insights on how to build sustainable wealth as an emerging high-earner. This article dives deep into managing lifestyle creep, understanding income tax, and making tax-efficient investments. Learn how to leverage everyday expenses to lower your tax bill and preserve wealth.

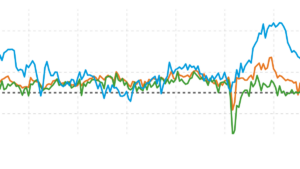

January inflation and spending data implies more noise than trend

The Federal Reserve's closely watched measure of inflation, the personal consumption expenditures index, continued to show strength in January, rising by 0.3%

How real is the wealth effect in a bull market?

Using a back-of-the-envelope calculation, we estimate that the sharp rebound in equities last year contributed to an increase of roughly $900 billion in households' stock wealth, or $288 billion in consumer spending.

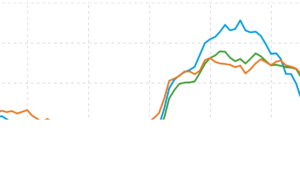

Builders look to capitalize on cautiously optimistic U.S. housing market forecast

Easing interest rates and other factors signal a potential housing market rebound.

Commercial real estate faces new financing landscape

Institutional investors seek quality and value amid a challenging commercial real estate market.

New home sales grew more slowly in January amid elevated mortgage rates

Sales of new homes grew 1.5% in January, much slower than the 7.2% increase in December, most likely because of elevated mortgage rates.