Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Travel industry, expecting busy summer, casts wary eye on inflation

With COVID-19 caseloads easing and consumers flush with savings built up during the

pandemic, the travel industry was anticipating a robust season.

States begin to consider digital asset taxation as sessions end

A number of states begin to consider or take steps related to the state taxation of digital assets as the economy for these assets continues to grow.

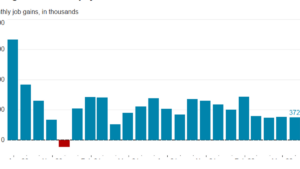

U.S. employment report for June indicates no recession now

An American economy in free fall does not tend to produce 372,000 jobs in any given month, as the June employment report showed on Friday. The data released by...

GASB revises requirements for accounting changes and error corrections

The Governmental Accounting Standards Board (GASB) has released Statement No. 100, Accounting Changes and Error Corrections (Statement 100), which amends GASB Statement No 62.

GASB revises requirements for compensated absences

The Governmental Accounting Standards Board has released Statement No. 101, Compensated Absences, replacing GASB Statement No. 16, Accounting for Compensated Absences.

Oklahoma proposes phasing out Corporate Income and Franchise Tax

Tax cuts, tax cuts, and more tax cuts. Is now the time for Oklahoma to cut corporate income and franchise taxes?

Cybersecurity governance and the board’s role

The SEC has proposed amendments to its cybersecurity rules for private companies. If enacted, some boards may require cultural and structural changes to address governance gaps.

Economic headwinds: Hospitality

Inflation is hitting the hospitality industry harder than the broader economy.

Job openings show signs of a slowdown

Job openings declined for the second straight month in May as the Federal Reserve's rate hikes slowed down overall demand.

Chart of the day: Service sector grows at slowest pace in two years

The ISM service index inched down to 55.3 in June, the slowest level of growth in more than two years since May 2020, when it was at 45.2.

U.S. June jobs preview: Slower hiring in rate-sensitive industries

We expect the June U.S. employment report to show a total gain of 225,000 jobs, with risk of a stronger pace of hiring and an increase in the unemployment rate to 3.7%.

RSM US Manufacturing Outlook Index shows a slowing industrial sector

Three of the Federal Reserve’s regional manufacturing surveys are now reporting outright contractions and the other two are falling quickly toward contraction.

Preparing for a tsunami of imported goods

The recent reopening of China’s factory floors and the easing of its supply chain bottlenecks have prompted discussion about the ability of the U.S.

New home sales rise unexpectedly despite higher mortgage rates

The increase was driven by more supply coming online, pushing prices down for the first time since February.

Five considerations for changing auditors

As your business grows, it's imperative to have an audit firm whose capabilities grow with you. Assess if it's time for a change.