Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

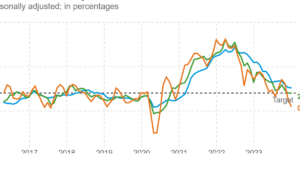

Spending remains strong as a key inflation gauge declines toward Fed’s target

Inflation dynamics to close out last year strongly point to a near-term return to the Federal Reserve's 2% inflation target amid a solid labor market, strong spending and real income gains.

FOMC preview: Modest adjustments will lead to pivot by midyear

The FOMC next week will almost certainly leave its policy rate unchanged between 5.25% and 5.5% and maintain the pace of quantitative tightening.

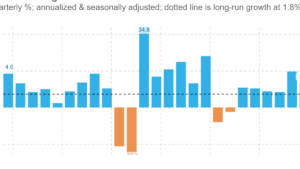

U.S. economy booms at a 3.3% pace in the fourth quarter

The U.S. economy last year expanded by a robust, above-trend pace of 3.1% and a fourth quarter pace on a seasonally adjusted rate of 3.3%.

Remote workforces are complicating state tax nexus and withholding

As businesses increase the use of remote workforces, nexus and withholding determinations can greatly complicate state tax compliance.

Compensation and benefits planning can help you navigate an aging workforce

Considerations for structuring compensation and benefit plans that help companies minimize the costs and risks of retiring workers.

The workers and workplaces of the future

How companies are adapting hiring practices and workforce strategies, given the shrinking U.S. labor force, according to the U.S. Chamber of Commerce.

From partnerships to side gigs, who really owes self-employment taxes?

Explore the impact of a recent legal shift that broadens the scope of self-employment taxes, including limited partners and gig workers. Learn how everyday activities could land you in the self-employment tax bracket and how to avoid potential penalties.

Self-employed? Here’s how to pick between a SEP IRA and Solo 401(k) for your retirement

Explore two popular retirement plans, SEP IRA and Solo 401(k), for the self-employed in this overview, focusing on their benefits, drawbacks, and the strategic considerations for choosing between them. Learn about higher contribution limits, flexibility, and tax advantages these plans offer. Get insight into which plan best fits your retirement goals and business structure.

Navigating the new DOL guidance on worker classification

The U.S. Department of Labor's new rule reinstates the "economic reality test" for distinguishing employees from independent contractors and underscores the significant legal and financial consequences of misclassification. This article provides an overview of the rule, its implications, and the steps employers must take to ensure their worker classifications are under the updated guidelines.

Expansion of energy tax credits under the Inflation Reduction Act

Discover how the IRA's expanded energy tax credits offer substantial incentives for a range of projects, from solar power to energy storage. Delve into the specifics of these credits and learn how these changes can benefit project developers and innovators in the energy sector.

Understanding the Backdoor Roth IRA

Are you a high-income earner seeking ways to optimize your retirement savings? Get a full grasp of how the Backdoor Roth IRA can be an effective tool for you.

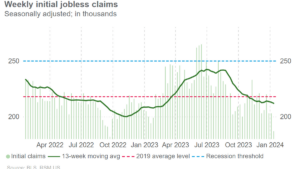

Initial jobless claims and housing starts post upside surprises

Filings for jobless benefits fell last week to the lowest level in 16 months, a testament for how resilient the labor market continues to be.

IRS Opens ERC Voluntary Disclosure Program

If you're a business owner who mistakenly claimed the Employee Retention Credit, find out how the new IRS Voluntary Disclosure Program can help you rectify the situation. Discover the eligibility criteria, benefits, and application process in our informative video.

Global economic outlook: Inflation

The world's economies are nearing price stability.

Global economic outlook: Income

China's per capita income grew at an astounding rate from 2000 to 2010, and similar growth is happening in India.