Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

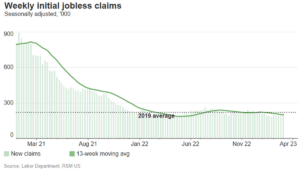

Initial jobless claims spike to highest level since December

New claims for jobless benefits last week came in hotter than expected at 211,000, significantly higher than the 190,000 of the previous week.

The new 2022 Schedule K-2 and K-3 filing exception for certain pass-through entities

The IRS announced a new filing exception for the 2022 tax year that allows domestic partnerships and S corporations to skip the completion and filing of Schedules K-2 and K-3 under certain circumstances. Read our article to learn more.

FASB votes to simplify accounting for common control leases

For common control leases, the FASB is drafting amendments to simplify determining whether a lease exists, the classification of the lease, and accounting for leasehold improvements.

Why adding children to your bank account or home deed could be a bad idea

Adding your kids to your bank account or home deed can create a host of legal, financial, and tax issues that can leave you and your loved ones vulnerable to significant risks and losses. Learn about the issues and alternative solutions to help you achieve your estate planning goals.

Proposed regulations on using forfeitures in retirement plans

Proposed regulations REG-122286-18, released Feb. 24, provide guidelines for plan administrators to use forfeited amounts in retirement plans.

Properly Funding Your Living Trust

Failing to properly fund a living trust is one of the most common errors people make and can lead to unintended consequences and added costs for both the individual and their beneficiaries. In this video, we'll provide an overview of how to properly fund a living trust.

R&E Expense Amortization Got You Down?

Now that Research & Experimentation expenses must be amortized over several years, many companies are looking for ways to increase deductions and reduce taxable income. Here are three opportunities to potentially accelerate depreciation and reduce your tax liability.

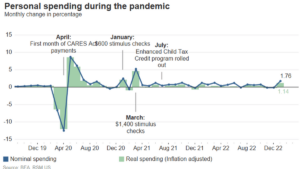

January’s spending shows a hot economy despite rate hikes

The Fed’s key gauge of inflation—the personal consumption expenditures deflator—rose by 0.6% on the month for both the top-line and the core numbers, bringing the year-over-year inflation to 5.4% and 4.7% for the two series, respectively.

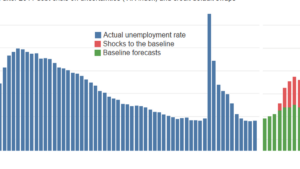

What would happen if the government defaults on its debt?

Policy brinksmanship over lifting the debt ceiling and the threat of default it brings is increasing the cost of doing business and carries far more risk than is commonly acknowledged.

The debt ceiling stand-off: Frequently asked questions

What exactly is the debt ceiling, and other frequently asked questions.

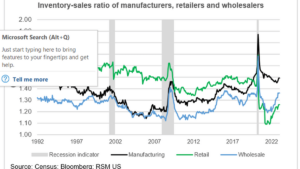

U.S. inventories are growing at twice the rate of sales

The surge in inventories raises the risk that firms will be caught with excess supplies just as demand begins to slow down this year.

Required minimum distributions after SECURE 2.0

SECURE 2.0 changes the rules governing how and when certain retirement savers can withdraw money from their retirement accounts and IRAs.

Retirement plan changes for long-term, part-time employees

SECURE 2.0 changes the rules for how long-term, part-time employees are treated for purposes of 401(k) and 403(b) retirement plans.

Retail sales post strong gains in January, though it may not last

Sales increased by 3.0% on the month and by 2.3% if automobiles are excluded, according to the U.S. Census Bureau.

Rising interest payments, deficits and the debt ceiling crisis

The mounting stand-off over raising the federal government’s debt ceiling has put a renewed focus on the rising cost of financing the nation’s debt.