Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

What you need to know about state inheritance & estate taxes

Many people are aware of the federal estate tax, but few realize that certain states also levy estate and inheritance taxes on the assets one leaves behind. Learn about which states impose taxes, what the tax rates are, and how they may affect your estate planning.

BSA/AML and OFAC risk assessment: Best practices for financial organizations

BSA/AML and OFAC risk assessments can help alleviate concerns for financial organizations. Develop a strategy for BSA/AML and OFAC compliance.

FOMC decision: Policy, price stability and balance sheet strategy

The Federal Reserve on Wednesday showed that it intends to achieve price stability, maximum sustainable employment and long-term growth despite the risk of a…

Succession Planning for Nonprofits

Grooming future leaders and mapping out a succession plan in advance is one of the best ways to mitigate the risk of losing key personnel and prepare for the future needs and growth of an organization. This video offers tips and best practices for creating and implementing a succession plan for your nonprofit.

The changing consumer: Tighter budgets and a shift to services

As inflation continues to rise, consumers must devote more of their monthly budgets to fixed costs like groceries, rent and energy.

The illusion of inventory and price controls

With inflation at 8.5% and risks of another energy price shock the impulse of policymakers to take more action is rising.

3 things to know before raising your prices

With rising prices proving to be stickier than expected, business leaders have been facing a challenge: how to set prices in a highly inflationary environment.

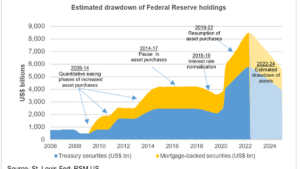

Confidence in the Fed, but uncertainty over long-term growth

The bond market anticipates an acceleration of Fed rate increases and a drawdown of the Fed's accumulation of long-term Treasury bond purchases.

Consumers spent more in March despite rising inflation

American consumers defied rising inflation and market uncertainties in March, continuing to spend more on goods and services as their wages increased and they…

U.S. GDP declines by 1.4%: This is what an overheating economy looks like

Growth in the first three months of the year contracted at 1.4% pace as Americans turned to imports to meet torrid demand that is simply unsustainable.

Pending home sales fell back to pre-pandemic level amid rising rates

pending home sales fell 1.2% in March, declining for the fifth month in a row, as demand continued to slow due to high prices and rising mortgage rates.

Durable goods orders bounced back in March

Orders for durable goods bounced back in March despite interest rate hikes and supply shocks from geopolitical conflict. The top-line durable goods orders…

Consumer confidence declines slightly as new home sales fall 8.6%

Consumer confidence eased in April despite an uptick in expectations, the Conference Board reported on Tuesday.

Auto lending compliance is changing course: How to prepare

Auto lending compliance is changing. Auto finance lenders need to be prepared for a more complex auto lending regulatory compliance landscape.

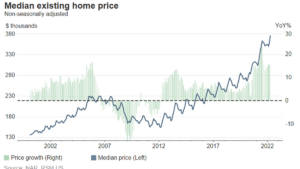

Chart of the day: U.S. home prices hit record in March

Sales of existing homes fell by 2.7% to 5.77 million in March, the lowest since July 2020, as rising mortgage rates dampened demand.

No results found.