Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

FOMC decision: Fed lifts policy rate to range of 4.25% to 4.5%

The Federal Reserve on Wednesday lifted its policy rate by 50 basis points and laid the groundwork for an eventual pause in interest rate increases early next year, even as it indicated it intends to continue lifting rates into a slowdown.

When will inflation slow? Pay attention to housing

A correction in the housing market as mortgage rates reach 20-year highs is underway.

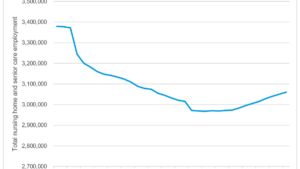

What do the latest job numbers say about the health care sector?

According to the latest nonfarm payroll report by the Bureau of Labor Statistics, health care added 44,700 jobs, exceeding our earlier estimate of 40,000.

When To Outsource Your Accounting

Thanks to the cloud and automation, outsourcing has never been a more viable option than it is today. Quite often, outsourcing can be more efficient and less expensive than hiring dedicated staff. In this video, we'll cover the benefits of outsourcing your accounting.

Retail sales surge, easing recession fears for now

Retail sales data surged in October as holiday shopping started early for the second year in a row.

How high will interest rates go?

We expect the Fed to raise its policy rate above 5% in the near term while at the same time reducing its balance sheet by $95 billion per month.

Congressional midterm election results anxiously awaited

Tax and midterm elections: Whether or not Republicans take control of the House, tax policy centers on a year-end extenders bill.

When will inflation slow? Pay attention to housing.

We estimate that there is an approximately 18-month lag between changes in housing prices and those in the housing inflation components.

Consumer sentiment falls as outlook worsens

The University of Michigan's consumer sentiment index declined by a sharp 5.2 points to 54.7 in the first half of November, slightly above the all-time low in June at 50, according to survey data released Friday

IRS opens determination letter program for 403(b) plans

Revenue Procedure 2022-40, allows 403(b) retirement plans to use the same individually designed retirement plan determination letter program currently used by qualified retirement plans.

Five Steps to Recognizing Revenue in Financials

The FASB and IASB have provided standards for properly recognizing revenue in your financials. Using a five step process, companies recognize revenue based on the value and timing of when control of the goods and services are transferred to the customer. Learn about the standards and how to properly recognize revenue for your company.

Consumer products holiday season insights: Retail holiday shopping expected to be strong this year

The holiday shopping season is expected to continue to show strong nominal spending by consumers.

U.S. October jobs report: Strong growth as labor market remains tight

Total employment increased by 261,000 jobs in October, which brought the total gain in employment this year to 4 million positions.

Fed raises its policy rate by 75 basis points as it prepares to slow pace of hikes

The Federal Reserve increased its policy rate by 75 basis points on Wednesday to a range between 3.75% and 4% as it hinted at slowing the pace of its hikes.

IRS makes statements on CARES Act Employee Retention Tax Credit risks

On Oct. 19, 2022 the IRS issued a news release warning employers to be wary of third parties who have ramped up campaigns to try and get employers to claim the CARES Act Employee Retention Tax Credit (ERTC) when they may not actually qualify.