Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

Retail demand shows weakness, leading to first inflation dip in 6 months

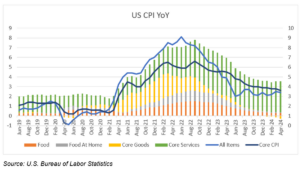

In a noteworthy turn, core goods prices have experienced a continued decline, contributing to the first dip in inflation in six months.

CPI resumes disinflationary trend in April amid weakened retail sales

Overall CPI inflation rose by 0.3% in April, while core inflation—which excludes food and energy—also rose by 0.3%. This helped bring the year-over-year headline inflation down to 3.4% and core inflation to 3.6%.

U.S. consumer sentiment plunges on rising inflation

Inflation expectations rose sharply to 3.5% from 3.2% for the next 12 months while longer-term expectations inched up to 3.1% from 3.0%.

The crucial role of data in financial institutions

Data collection is easy, using it well is hard. For finance, data fuels innovation, guiding decisions, growth, and risk mitigation.

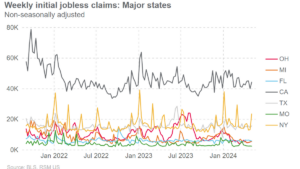

Initial jobless claims rise to the highest level since August

Our preferred metric of new claims—the 13-week moving average—rose slightly to 211,000, still below the pre-pandemic level.

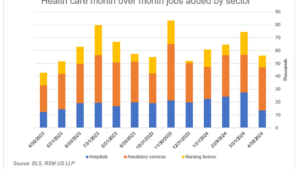

Robust jobs growth continues in health care

Health care job gains remain strong, according to the U.S. monthly report on April numbers.

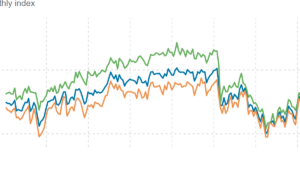

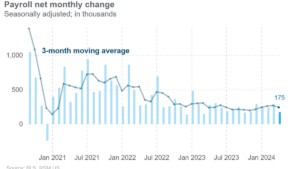

U.S. monthly employment report: Hiring cools in April

Hiring cooled in April from the torrid pace of 269,000 jobs on average during the first three months of 2024 as the economy generated an average increase of 175,000 in total employment.

IRS releases plan to triple its audit rates on large corporations

Audit rates on large corporations to increase threefold, per newly released IRS roadmap for spending Inflation Reduction Act funds.

Global regulatory pressures are closing the cybersecurity governance gap

Pressure on cybersecurity governance is increasing, with new objective measures for management, but also subjective standards for the board.

Job openings fall to a three-year low as manufacturing softens

Job openings in March plunged to 8.49 million, the lowest level in three years, according to the Bureau of Labor Statistics on Wednesday.

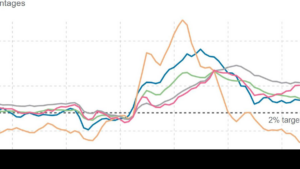

Fed holds rates steady as rebound in inflation hampers progress

Citing a lack of progress in reducing inflation, the Federal Reserve kept its policy rate unchanged at 5.5% at its meeting on Wednesday, the same rate it has had since July.

Protecting Your Business From Internal Fraud

Did you know that over half of all business fraud stems from inadequate internal controls? In this video, we'll provide you with four specific controls you can implement to help protect your business.

2024 Update: waiver of RMDs for inherited IRA beneficiaries

The IRS's latest notice suspends RMDs for some inherited IRAs in 2024, offering beneficiaries a financial breather. Find out if you qualify for this waiver and how it affects your tax obligations.

Strategic depreciation practices for tax savings

Understanding the best approach to depreciation can be game-changing for your business. Don’t miss out on essential tax savings that could optimize your cash flow. Click to explore effective strategies that buisness owners are using to enhance their financial outlook.

Should you set up voluntary withholding for your social security payments?

Unsure whether to set up voluntary withholding for your social security payments? This guide breaks down the concept of voluntary withholding, showing how it can help spread your tax liability over the year and make budgeting simpler.

No results found.