Resources

Videos and Articles

Entity Type:

Content Type:

Industry:

- All

- Automotive

- Business Services

- Construction

- Consumer Goods

- Consumer Products

- Energy

- Financial Institutions

- Financial Services

- Food and Beverage

- Food Beverage

- Government

- Health Care

- Healthcare

- HIPAA HITECH Compliance

- Hospitality

- Life Sciences

- Manufacturing

- Nonprofit

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- Restaurant

- Retail

Service:

- All

- Accounting

- Audit

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Employee Benefit Plans

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Financial Advisory

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Governance, Risk and Compliance and Enterprise Risk Management

- International Tax Planning

- Investment Advisory

- Managed Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- Operations and Supply Chain

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- SEC

- Security and Privacy

- State and Local Tax

- Strategy and Management Consulting

- Tax

- Technical Accounting Consulting

- Technology Consulting

- Technology Risk

- Washington National Tax

- Wealth Management

Topic:

- All

- AICPA Matters

- Anti-money Laundering

- Artificial Intelligence

- ASC 842

- Blockchain

- Board Insights

- Business Growth

- Buying Patterns

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Cryptocurrency

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Fund Management

- Global

- Inflation

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Owner

- Payroll and Employment

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue Recognition

- Risk and Opportunity

- Risk Management

- SEC Matters

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

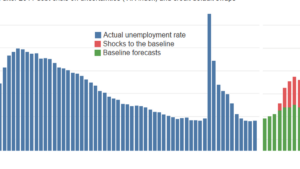

What would happen if the government defaults on its debt?

Policy brinksmanship over lifting the debt ceiling and the threat of default it brings is increasing the cost of doing business and carries far more risk than is commonly acknowledged.

The debt ceiling stand-off: Frequently asked questions

What exactly is the debt ceiling, and other frequently asked questions.

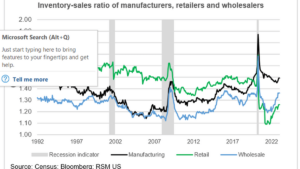

U.S. inventories are growing at twice the rate of sales

The surge in inventories raises the risk that firms will be caught with excess supplies just as demand begins to slow down this year.

Required minimum distributions after SECURE 2.0

SECURE 2.0 changes the rules governing how and when certain retirement savers can withdraw money from their retirement accounts and IRAs.

Retirement plan changes for long-term, part-time employees

SECURE 2.0 changes the rules for how long-term, part-time employees are treated for purposes of 401(k) and 403(b) retirement plans.

Retail sales post strong gains in January, though it may not last

Sales increased by 3.0% on the month and by 2.3% if automobiles are excluded, according to the U.S. Census Bureau.

Rising interest payments, deficits and the debt ceiling crisis

The mounting stand-off over raising the federal government’s debt ceiling has put a renewed focus on the rising cost of financing the nation’s debt.

Business ownership: Launch with confidence

Discover the opportunities and challenges as you get ready to take your business to the marketplace. RSM advises business owners in all phases of the business lifecycle.

Business ownership: Business transition

Preparing for the sale or transition of a business. RSM advises business owners in all phases of the business lifecycle.

Business ownership: The dynamics of a mature business

Mature businesses need to prepare for what lies ahead. RSM advises business owners in all phases of the business lifecycle.

Business ownership: A focus on growth

The business startup lifecycle: Answers to common questions business owners ask in the growth stage.

Business ownership: Startup challenges and opportunities

Starting a business is exhilarating and daunting. RSM advises business owners in all phases of the business lifecycle.

Paycheck Protection Program: Speed came at a price

The Paycheck Protection Program had a clear impact on preserving jobs among small and midsize businesses. But it came at a steep cost, both in dollar terms and in reach.

4 areas of focus for financial institutions in early 2023

Despite the lift in financial institutions" net interest margins from unprecedented rate hikes, the headwinds facing the industry through declining macroeconomic conditions are creating unique downside risks for the nation’s banking system.

Protecting Your Finances During an Economic Downturn

Many economists are predicting that the US economy will experience a downturn, if not a recession, in 2023. A downturn can lead to job loss, reduced income, and financial insecurity. While it's impossible to predict the future with certainty, there are steps you can take to protect your finances during a downturn.

No results found.