Resources

IRS opens determination letter program for 403(b) plans

TAX ALERT | November 08, 2022

Authored by RSM US LLP

Executive summary: Determination letters for 403(b) plans

Revenue Procedure (Rev. Proc.) 2022-40, released by the IRS on Nov. 7, 2022, allows 403(b) retirement plans to use the same individually designed retirement plan determination letter program currently used by qualified retirement plans e.g., 401(k) plans.

Rev. Proc. 2022-40

The IRS published Rev. Proc. 2022-40 along with the accompanying IRS release IR-2022-196 on Nov. 7, 2022. The Revenue Procedure permits 403(b) retirement plans, which are used by certain public schools, churches and charities, to begin using the same individually designed retirement plan determination letter program currently used by qualified retirement plans. Previously, a 403(b) plan could only have reliance that the basic terms of the plan met the 403(b) regulations if it used an IRS preapproved plan format. Complicated plans, such as plans maintained by large healthcare systems had no effective way of seeking IRS review and approval of the plan document.

Generally, an individually designed plan is a retirement plan drafted to be used by only one plan sponsor. An IRS determination letter expresses an opinion on the qualified status of the plan document. Form 5300 is the application for determination for individually designed retirement plans, Form 5307 is the application for determination for adopters of modified volume submitter or pre-approved plans and Form 5310 is the application for determination for terminating plans.

Timing of submission of determination letter applications for 403(b) plans

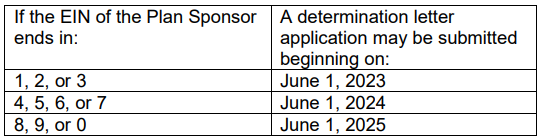

Beginning on or after June 1, 2023, a 403(b) plan sponsor may submit a determination letter application for newly adopted, ongoing and terminating 403(b) plans. The initial plan determination application submission dates are based on the Plan Sponsor’s EIN (see chart).

For a determination letter on plan termination (using Form 5310) a plan sponsor may submit an application anytime on or after June 1, 2023, and there is no schedule based on the EIN.

Changes for all plans

Currently, a plan sponsor can request a determination letter only if any of these apply:

- The plan has never received a favorable determination letter (an initial plan determination),

- The plan is terminating, or

- The IRS makes a special exception.

Changes to the submission and processing of all individually designed retirement plan determination letter applications include:

- A prior letter issued to a pre-approved plan adopter will not be treated as an initial plan determination – A determination letter issued to an adopter of a pre-approved retirement plan as a result of filing a Form 5307 (Application for Determination for Adopters of Modified Volume Submitter Plans) is no longer considered in determining whether a plan sponsor is eligible to submit that plan for a determination letter for an initial plan determination on a Form 5300 (Application for Determination for Employee Benefit Plan). This gives plan sponsors that have such letters an opportunity for an updated determination letter.

- Scope of review – in its review, the IRS will generally consider qualification requirements and section 403(b) requirements that are in effect, or that have been included on a Required Amendments List, on or before the last day of the second calendar year preceding the year in which the determination letter application is submitted, subject to any specified modifications in the annual Employee Plans revenue procedure that provides the administrative and procedural rules for submitting determination letter applications (currently Rev. Proc. 2022-4). For example, a plan sponsor filing a determination letter request on June, 1, 2023, would need to first review the plan against the requirements of the 2021 Required Amendment List (Notice 2021-64) and all other prior Required Amendments.

IR-2022-196 indicated that Rev. Proc. 2023-4, currently in development, will be released in the near future and will contain additional changes to procedural requirements for plan determination letter submissions, such as phasing in mandatory e-submission of determination letter requests. Forms 5300 and 5310 will also be updated to reflect these changes.

Let's Talk!

Call us at (325) 677-6251 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Bill O’Malley, Chloe Webb and originally appeared on 2022-11-08.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/tax-alerts/2022/irs-opens-determination-letter-program-for-403-b-plans.html

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Condley and Company, LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Condley and Company can assist you, please call (325) 677-6251.