Navigating the tax landscape: Understanding DOE Home Energy Rebate Programs.

Institutional investors seek quality and value amid a challenging commercial real estate market.

Easing interest rates and other factors signal a potential housing market rebound.

The IRS and Treasury released proposed regulations with respect to prevailing wage and apprenticeship requirements for clean energy tax incentives.

For common control leases, the FASB is drafting amendments to simplify determining whether a lease exists, the classification of the lease, and accounting for leasehold improvements.

Inflation is hitting the hospitality industry harder than the broader economy.

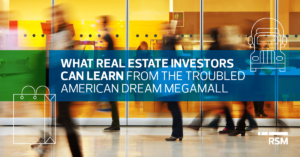

What happens when a real estate investor does not look at changing consumer preferences when undertaking a new project?

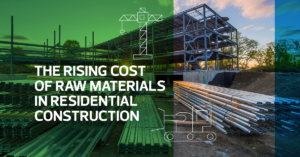

Even as the housing market leads the U.S. economic recovery, homebuilders are facing new pressures as they try to meet surging demand.

Construction firms forced to reduce or cancel operations by jurisdictional order may meet employee retention credit eligibility requirements.

There are a number of steps construction companies can take to help avoid unintended losses resulting from error or outright fraud.

Everything from lumber to asphalt to cement to insulation has soared in price as the homebuilding industry has heated up.

Despite receipt of PPP loans, hospitality businesses may be eligible for retroactive 2020 and new 2021 credits.

The package provides additional funding for the Paycheck Protection Program and allows certain borrowers to draw second round of PPP funding

Based on Biden’s campaign platform, long-term capital gains, currently taxed at 20%, would be taxed at ordinary income rates.