Resources

The return to office slows in the technology sector

ARTICLE | September 21, 2021

Authored by RSM US LLP

Like many businesses across the economy, technology companies continue to reassess the timing and scale of their return-to-office plans as COVID-19 cases rise around the United States. During the second quarter of this year, pandemic data in many parts of the country was improving; hospitalizations were going down and more people were getting vaccinated. Then, in July, the news turned as concerns over the new delta variant spiked.

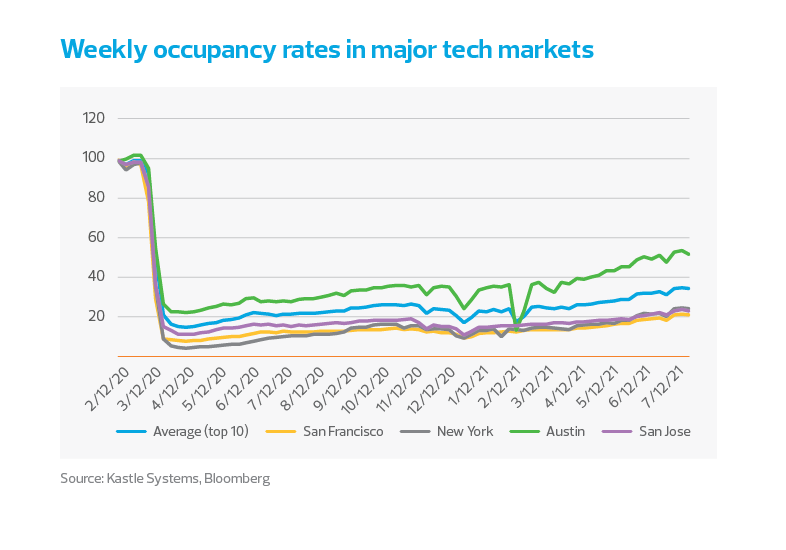

Data from Kastle Systems, a security management company, sheds some light on what the return to the office looks like across 10 major U.S. cities. The company tracks access card swipes in its commercial buildings in these cities, and this information shows how building occupancy plummeted in March 2020 and has in recent months been gradually increasing.

This data—shown in the accompanying chart—spans multiple industries. The share of people returning to inperson work in the technology sector is likely lower, given that many tech workers can do their jobs remotely.

Middle market tech companies may have the flexibility to remain more nimble navigating between remote work and returning to the office.

Two of the largest technology hubs in the United States— the Bay Area (comprising San Jose and San Francisco) and New York—have had a below-average number of workers returning to the office. Austin, Texas, another technology hub, has had the most significant returnto-office percentages; more than 1 of every 2 workers— across the economy as a whole—returned to in-person work during several weeks in July. (While keeping in mind that many factors are at play in rising COVID-19 cases, it is notable that Texas has had a higher number of cases per capita than California and New York, according to CDC data from Aug. 16.)

Tech companies respond

Tech companies, like many individual Americans, are tracking and assessing the latest COVID-19 information in order to manage risk. Each month that the pandemic continues, workers continue to get more accustomed to working from home. Within the last two weeks, several big technology companies have discussed their plans for returning to the office:

- Microsoft, Google and Uber have delayed their companywide return to office from September to October.

- Amazon, Lyft and Roblox have delayed the return to office until sometime in the first quarter of next year.

- Twitter had already opened its offices in July of this year, and has subsequently paused its reopening. (Twitter also announced in 2020 that employees could work from home indefinitely.)

There is also the question of whether companies will require employees to be vaccinated against COVID-19 in order to return in person. Here is how several large companies—in tech and beyond—have handled this matter:

- Beginning in September, Microsoft will require employees to show proof of vaccination when entering the office.

- Facebook and Google are requiring their employees visiting an office to be vaccinated.

- Walmart, the largest private employer in the United States, is requiring back-office employees to get vaccinated by Oct. 4 and continues to provide cash incentives for frontline store workers to get the vaccine.

- Walt Disney employees will be required to be vaccinated. Additionally, the company has entered into conversations with unions about requiring vaccines for those working under collective bargaining agreements.

Middle market implications

Some early-stage technology companies have never had an office and employees will continue to work remotely after the pandemic. Other technology companies, particularly late-stage or more mature firms, have already been back in the office for months. Middle market tech companies may have the flexibility to remain more nimble in navigating between remote work and returning to the office.

History has shown that management teams at midmarket tech companies will look to what Big Tech companies in Silicon Valley are doing to inform their approach. Companies of all sizes will have to be strategic about how they navigate returning to in-person work, given the battle to attract and retain top talent. Whether it’s after Labor Day or sometime in 2022, it will be interesting to see how the sector continues to address this issue—and how employees will respond.

Let's Talk!

Call us at (325) 677-6251 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Kurt Shenk and originally appeared on None.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/economics/the-return-to-office-slows-in-the-technology-sector.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Condley and Company, LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Condley and Company can assist you, please call (325) 677-6251.