Resources

Slowing U.S. EV sales, high manufacturing costs will drive search for efficiency

ARTICLE | January 08, 2024

Authored by RSM US LLP

Electric vehicle (EV) adoption in the United States has been slower than automakers and policymakers had hoped, although recent sales growth is still robust.

U.S. battery electric and plug-in hybrid vehicle sales grew almost 55% in the first three quarters of 2023 compared to the same period in 2022, resulting in a total of 865,500 units sold by the end of September. However, this number means the 2023 total is on track to be significantly below the year’s forecast of 1.7 million vehicles, projected by Bloomberg New Energy Finance earlier in the year.

The higher cost of EVs compared to their hydrocarbon cousins, the lack of fast and reliable charging infrastructure, battery performance issues and range are often cited by buyers as reasons they didn’t purchase an EV earlier. Higher vehicle financing costs are now an added factor that will further sap demand. Most buyers in the United States can take advantage of the EV tax credit so long as certain conditions are met, but this often isn’t enough to coax buyers to sign.

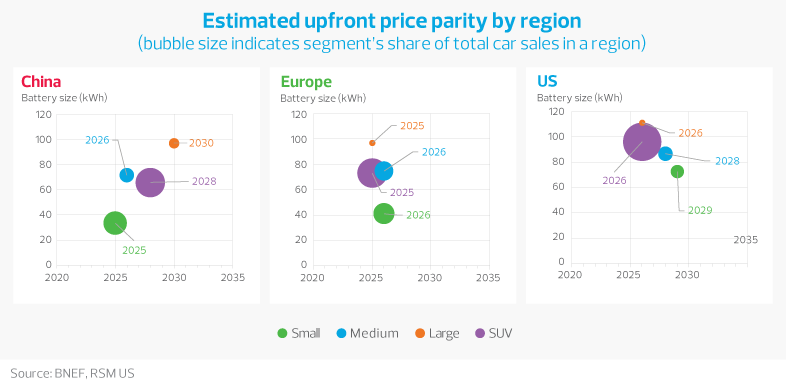

Even with a maximum credit of $7,500, the upfront cost of a battery EV significantly exceeds a comparable internal combustion engine (ICE) model. And in contrast with China and Europe, the North American market does not yet offer affordable mass-market EV models.

Slow EV demand leads to price pressures

In this environment, automakers face the challenge of balancing slowing demand with the need to protect sales volumes and market share, which often leads to price cuts. The average price of an EV in the U.S. was $50,683 in September, which is a significant decline from $65,000 a year prior, according to Cox Automotive. This price drop imposes considerable pressure on profit margins, particularly as EV production costs are typically higher than those of ICE vehicles, and current economic conditions intensify that pressure.

With moderating sales expectations, several automakers have already announced pullbacks or delays in their EV production and investments. Here’s a look at several factors driving production costs higher:

- Battery cost: EV batteries continue to make up 40% to 50% of automakers’ manufacturing costs. In 2022, prices for lithium ion batteries spiked due to rising raw material costs; prices for battery metals such as cobalt, nickel, manganese and lithium increased significantly in 2021 and 2022. Now, with weakening demand and slowing economies across the globe, most battery metal prices have eased. Still, it will take a few years before battery EVs reach price parity with ICE vehicles, especially in the North American market, which favors larger-battery EVs. Margin dynamics for EV models forecast losses until the battery costs subside and EV sales volumes ramp up.

- The rising cost of labor: Following the concessions made during the financial crisis in 2008-09, automakers experienced a remarkable surge, witnessing as much as a 60% increase in revenue and an impressive 75% boost in margins.

- However, as employee-related costs surge on the backs of union negotiations and a continually evolving labor landscape, the industry faces a transitional moment. The recently ratified United Auto Workers deal, set to increase employee costs by 25% to 30% for major automotive players, introduces more complexity. Even before the ratification of the new UAW contract, the Big Three automakers’ labor costs were nearly 50% higher than those of the nonunionized competitors. The new deal will further widen this labor cost disadvantage.

- This will drive manufacturing costs and prices even higher—in some automakers’ estimations, the new contract could cost a buyer an additional $850 to $950 per vehicle. Beyond those financial implications, the UAW's potential expansion into historically nonunionized southern plants and among workers at other automakers could influence the industry's shift to EVs, given the mixed sentiments among unionized workers.

- Given these added costs, manufacturers must find additional efficiencies within their operations and their supply chains.

- Shifting supply chains: The auto industry is efficient at sourcing high-quality components, usually at a low cost from countries like China, Mexico and South Korea. However, several suppliers that source and manufacture in China are now under pressure to de-risk and diversify their supply chain elsewhere. This, too, will add to higher costs as some manufacturers shift production to less efficient locations. Potentially higher labor costs in new jurisdictions, capital investments required to set up production, the time necessary to achieve economy of scale, and the availability and parity of government incentives can all result in higher production costs and additional margin pressures.

Operational efficiencies will be paramount

Addressing tight margins in the automotive industry requires a strategic approach. Here are specific actions that automakers can consider:

- Implement AI vision technology: Artificial intelligence technology is all the rage, but it’s not always clear to manufacturers how best to adopt it. One AI tool that is relatively easy to implement and train is AI vision technology, which can help spot defective or damaged product on the production line. This technology can also identify workers who are operating equipment in an unsafe manner, so management can address any safety training needs.

- De-risk the supply chain: Automakers and suppliers should work together to explore alternative sourcing strategies to reduce procurement costs and risks in their complex supply chains. These include new approaches that permit noninvasive analyses of multilayered supply chains without the need for difficult-to-obtain supplier data. Providers can piece together external data sets, such as information from global credit bureaus, to formulate the most robust supplier picture possible. This helps automakers better spot risks when evaluating new and existing suppliers.

- Map the value stream: Creating a holistic map of the end-to-end manufacturing process seems like an obvious step in the effort to enhance efficiency, but companies seldom do it. This exercise can enable management to spot key bottlenecks and redesign production steps to improve product quality or cost benefit. A map of the value stream can also help the entire team visualize processes, making it easier to communicate about issues and find solutions.

Let's Talk!

Call us at (325) 677-6251 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Kendra Blacksher, Matt Dollard, Irina Im and originally appeared on 2024-01-08.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/automotive/slowing-us-ev-sales-high-manufacturing-costs-drive-search.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Condley and Company, LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Condley and Company can assist you, please call (325) 677-6251.